" Introducing False EUR and False EUR exchange rates," International Review of Financial Analysis, Elsevier, vol. " Dynamic linkages between emerging European and developed stock markets: Has the EMU any impact?," Physica A: Statistical Mechanics and its Applications, Elsevier, vol. " Multifractal detrended cross-correlation analysis between the Chinese stock market and surrounding stock markets," Ma, Feng & Wei, Yu & Huang, Dengshi, 2013." DCCA cross-correlation coefficient: Quantifying level of cross-correlation," " International equity market integration: Theory, evidence and implications," " Are Industrial-Country Consumption Risks Globally Diversified?,"Ĭ93-014, University of California at Berkeley.Ĥ308, National Bureau of Economic Research, Inc.Ģ33194, University of California-Berkeley, Department of Economics. " An Investigation of Global and Regional Integration of ASEAN Economic Community Stock Market: Dynamic Risk Decomposition Approach,"Įmerging Markets Finance and Trade, Taylor & Francis Journals, vol. Qt26x5h54t, Department of Economics, UC Santa Cruz. Cheung, Yin-Wong & Chinn, Menzie David & Fujii, Eiji, 2003.Qt89s3z523, Department of Economics, UC Santa Cruz.

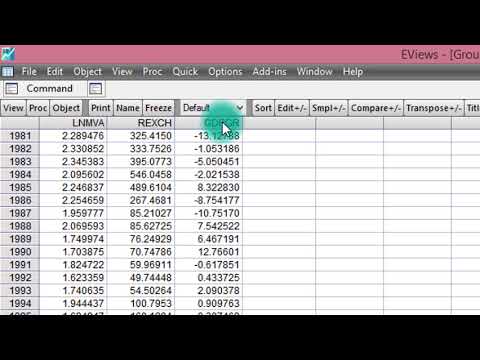

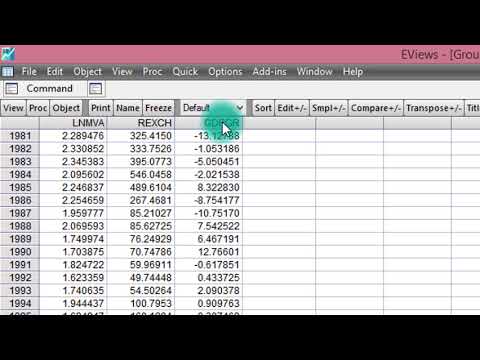

#GREGORY AND HANSEN COINTEGRATION TEST IN EVIEWS 9 SERIES#

Santa Cruz Department of Economics, Working Paper Series Chinn & Eiji Fujii, 2005.Ġ72005, Hong Kong Institute for Monetary Research.

Chinn & Eiji Fujii, 2003.ġ0047, National Bureau of Economic Research, Inc. Qt89s3z523, Center for International Economics, UC Santa Cruz. Santa Cruz Center for International Economics, Working Paper Series " The Chinese Economies in Global Context: The Integration Process and Its Determinants,"

Cheung, Yin-Wong & Chinn, Menzie & Fujii, Eiji, 2003. Journal of Monetary Economics, Elsevier, vol. " Comovements in national stock market returns: Evidence of predictability, but not cointegration," " Diversification potential of Asian frontier, BRIC emerging and major developed stock markets: A wavelet-based value at risk approach,"Įmerging Markets Review, Elsevier, vol. Mensi, Walid & Shahzad, Syed Jawad Hussain & Hammoudeh, Shawkat & Zeitun, Rami & Rehman, Mobeen Ur, 2017. " Rational Speculative Bubbles: An Empirical Investigation of the Middle East and North African (MENA) Stock Markets," RTS00236, Boston College Department of Economics. " ZIVOT: RATS procedure to perform Zivot-Andrews Unit Root Test," " Further Evidence on the Great Crash, the Oil Price Shock, and the Unit Root Hypothesis,"ĩ44, Cowles Foundation for Research in Economics, Yale University. Journal of Financial Economics, Elsevier, vol. " Dating the integration of world equity markets," " Statistical test for ΔρDCCA cross-correlation coefficient," " Quantifying the contagion effect of the 2008 financial crisis between the G7 countries (by GDP nominal)," da Silva, Marcus Fernandes & de Area Leão Pereira, Éder Johnson & da Silva Filho, Aloisio Machado & de Castro, Arleys Pereira Nunes & Miranda, José Garcia Vivas & Zebende, Gilney Figueira, 2016. Gupta, Rakesh & Guidi, Francesco, 2011.ħ277, University of Greenwich, Greenwich Political Economy Research Centre. 21(C), pages 10-22.ġ9853, University Library of Munich, Germany. " Cointegration relationship and time varying co-movements among Indian and Asian developed stock markets," Gupta, Rakesh & Guidi, Francesco, 2012. " Integration of world leaders and emerging powers into the Malaysian stock market: A DCC-MGARCH approach,"Įconomic Modelling, Elsevier, vol. Lean, Hooi Hooi & Teng, Kee Tuan, 2013. " The Co†movement Dynamics of European Frontier Stock Markets,"Įuropean Financial Management, European Financial Management Association, vol. Jarno Kiviaho & Jussi Nikkinen & Vanja Piljak & Timo Rothovius, 2014. " Risk-Taking, Global Diversification, and Growth,"Ĭenter for International and Development Economics Research (CIDER) Working PapersĬ93-016, University of California at Berkeley.Ĥ093, National Bureau of Economic Research, Inc.Ģ33197, University of California-Berkeley, Department of Economics. " Risk-taking, global diversification, and growth,"ĭiscussion Paper / Institute for Empirical Macroeconomics

0 kommentar(er)

0 kommentar(er)